Iran

‘Iran Army ready to give crushing response to any aggression’

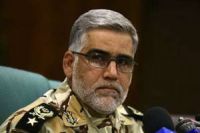

Commander of the Iranian Army Ground Force Brigadier General Ahmad Reza Pourdastan said on Friday Army is ready to give a crushing response to any aggression.

According to IRN, he made the remarks in a speech before Tehran’s Friday prayer sermons.

The senior commander noted “Iran’s defense doctrine is peaceful in nature but enemies should know that Iran’s army is vigilant about enemy movements both in regional and international scopes.”

Elsewhere in his speech he referred to the terrorist groupsˈ movements in the Southeastern province of Sistan and Baluchestan.

He warned the terrorists about the consequence of their actions.