Saudi regime pressuring wealthy families to fund Aramco IPO after Yemeni strike

Saudi Arabia is pressuring wealthy families to invest in the initial public offering (IPO) of Aramco after suffering substantial damage from a major Yemeni drone attack, according to reports.

Riyadh has drawn up a plan to “strong arm”, “coerce” or “bully” the families into the project, according to the London-based international business daily The Financial Times.

Many of the targeted families were already being pursued as part of a so-called “anti-corruption” crackdown launched in 2017, when Saudi royal family were imprisoned in the Ritz Carlton hotel, some of which were tortured.

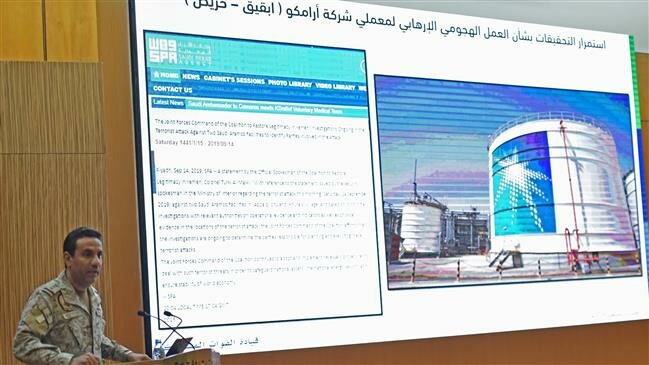

The report comes nearly a week after the Yemeni Armed Forces launched a major drone attack against Saudi Arabia’s oil facilities, effectively halving the kingdom’s oil production.

Saudi oil output halved after Yemeni raids; US blames IranYemeni drone strikes on key Saudi oil facilities wipe out half of the kingdom’s crude and gas production power, with the US rushing to blame Iran.

The latest attack also came as Saudi Arabia, the world’s top crude exporter, had been accelerating preparations for a much-anticipated initial public offering of Aramco.

The IPO forms the cornerstone of a program envisaged by de facto ruler Crown Prince Mohammed bin Salman, a son of King Salman, to replenish the kingdom’s once buoyant reserves which have dwindled amid falling oil prices and the protracted Yemen war.

JPMorgan, Goldman Sachs, Morgan Stanley and Credit Suisse are among Western financiers working on the IPO.

The recent Yemeni attack is speculated to take a heavy toll on the project, with Reuters reporting that the Aramco facilities may need months to restore its oil output after the attack cut five percent of the world’s oil supply.